Ordinary Rate of Pay Malaysia

The capital gains tax property six-year absence rule will also appeal to homeowners wanting to make some additional money for the period that they are not able to reside in their home all without prompting the need to pay CGT upon its eventual sale. Apply updated salary and wages or hours to a draft pay run.

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

However where dividends are to be distributed out of profits the directors must be able to satisfy that the company will be solvent within 12 months immediately after distribution is made.

. Additionally Section 60D 3b states that an employee who works on a holiday shall be entitled to a travelling allowance for that day if payable to them under the terms of their agreement with their employer but such. No employee shall be entitled to paid sick leave for the period during which the employee is entitled to maternity allowance or for any period during which he is receiving any compensation for disablement. In another instance in March 1986 the CPF Ordinary Account rate was 578 per cent.

Therefore ABC Sdn Bhd suffered. Lets go with the same example above an FD with 365 pa. Basic device with crown above.

As the labour market tax also applies the combined tax rate is 3284 each year during the 84-month period. The applicable tax regime in Malaysia for the construction industry is set by the Sales Service Tax Acts 2018 which impose tax at the rate of 6 on all sales or services rendered. At the end of the day keeping track of your leave entitlements and understanding your rights and legal obligations is crucial.

Michael purchased a house in Brisbane and has lived in it for the past four years. Click Reset Payslip to bring through the new salary and wage. This means our HDB concessionary loan rate would have been 588 per cent he said.

The same employees hourly rate of pay would be RM1250 RM100 8 hours RM1250---. Chief petty officer qualified for higher rate of pay not applicable to Coder Supply and Secretariat Artisan and Sick Birth Branches Before 1947 each branch developed its own. Interest for 6 months and investment of RM20000.

Pay The employer shall pay the employee his ordinary rate of pay for every day of such sick leave. Work force hire scheme. Click the draft pay run to open it.

Heshe will have an ordinary rate of pay of RM100 RM2600 26 RM100. Under Add select the pay item type as Other gross earnings and the rate type as Multiple of employees ordinary earnings so its set up to accrue leave. Add the pay item to an employee.

Any payment made under an approved incentive payment scheme or. In interest whereas money in your Save Pot a minimum of RM20 in your Save Pot earns you a bonus of 150 pa. 10 x ordinary rate of pay one days pay iii.

Alternatively the constitution may confer on preferential shareholders the right to receive the same rate of dividends as ordinary shares but in priority to the ordinary shares. Petty officer qualified for higher rate of pay. Add the custom pay item to the employees payslip in the pay run period the public holiday falls in.

In the Payroll menu select Pay employees. An employee may be required to work on any paid holiday subjected to two days wages at the ordinary rate of pay. Yearly Interest Rate12 Months x Placement Period In months Effective Interest Rate EIR 0036512 x 6.

Overtime on Rest Day. More than half but up to. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

On top of the 030 pa. Use of the 3rd Party Website will be entirely at your own risk and subject to the terms of the 3rd Party Website including those relating to confidentiality data privacy and security. Name the pay item and complete the other details as needed.

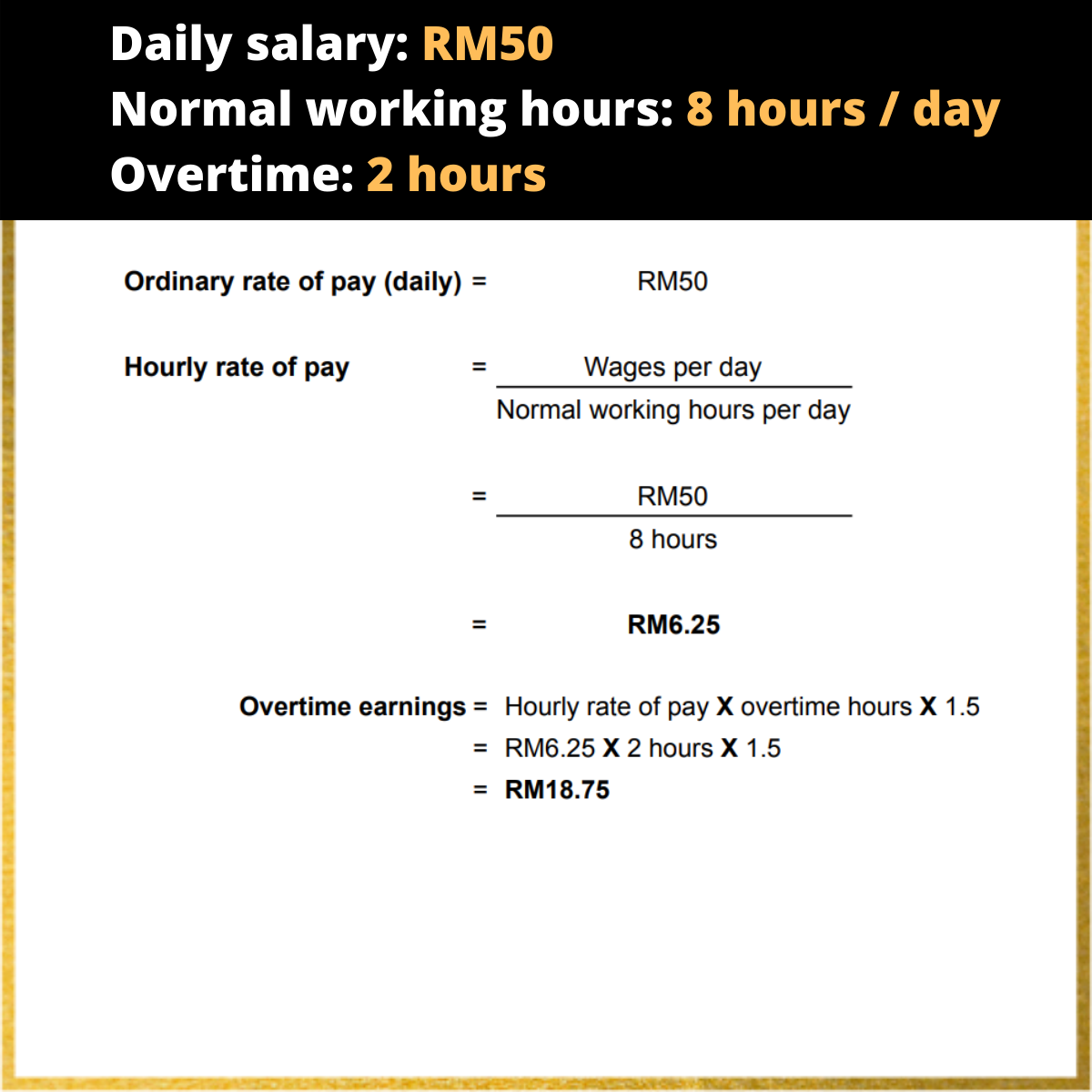

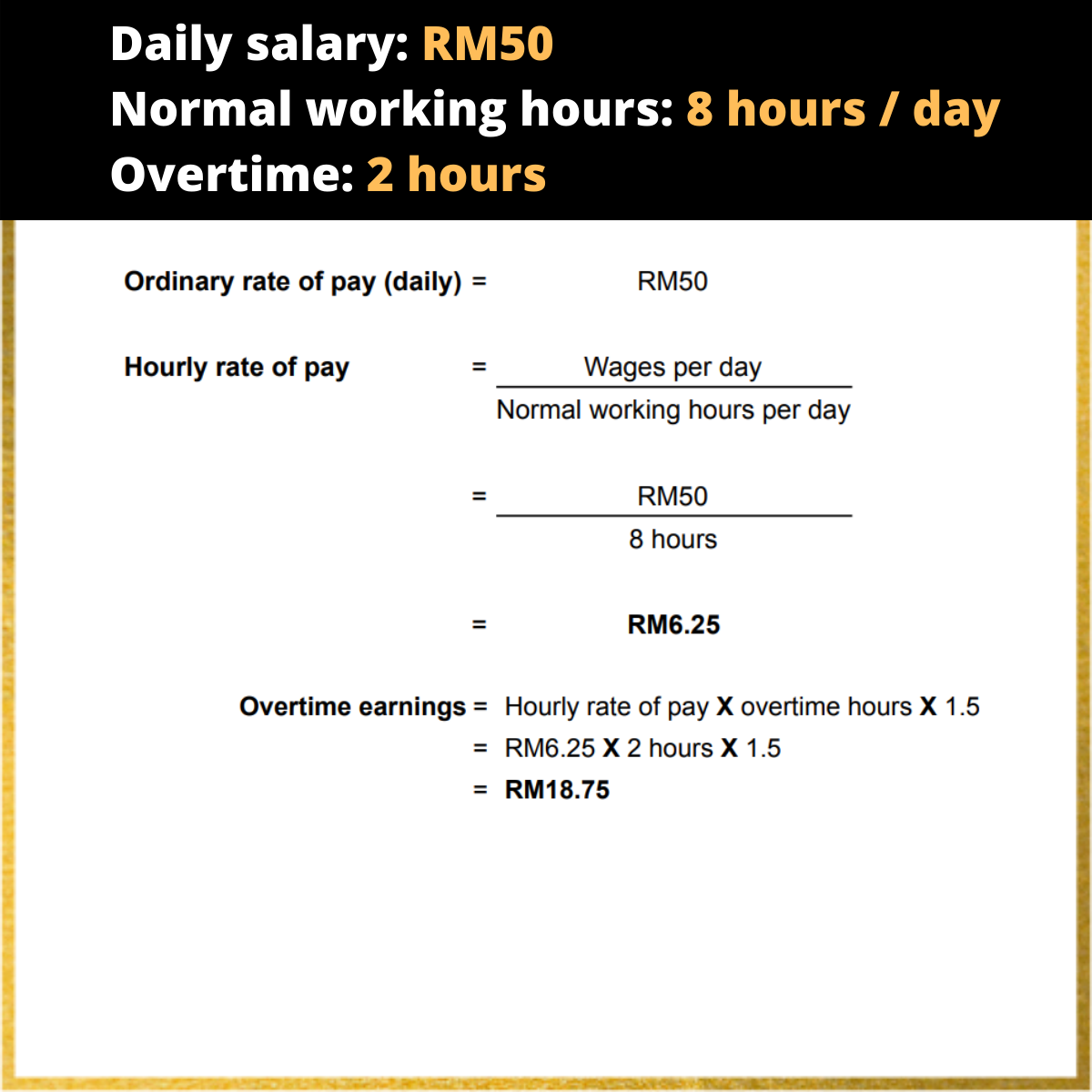

The Spend Pot earns you 030 pa. The exchange rate had varied to the disadvantage of the company and this resulted in the company having to pay RM2000 RM44000 less RM42000 more for USD10000. How to calculate Ordinary Rate of Pay and Hourly Rate of Pay.

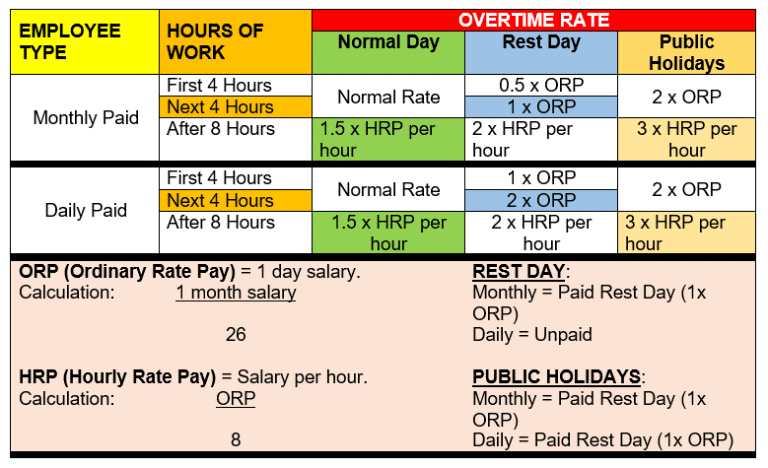

Under Earnings Rate update the employees salary pay rate or ordinary hours. Select the Pay Items tab. In excess of eight 8 hours-15 x hourly rate x number of hours in excess of 8 hours.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The Spend Pot works like an ordinary savings account which you can withdraw funds from whereas the Save Pot comes with a higher interest rate and is designed to encourage saving. Basic device with crown above star below.

No deductions are allowed against the flat rate taxed income. Basic device with crown above. Click the employees name to open their payslip.

The employees stay in Denmark may be longer. Ordinary Rate of Pay OPR OPR means wages whether calculated by the month the week the day the hour or by piece rate or otherwise which an employee is entitled to receive for the normal hours of work for one day. Section 60F3 of the Employment Act 1955 states The employer shall pay the employee his ordinary rate of pay for every day of such sick leave and an employee on a monthly rate of pay shall be deemed to have received his sick leave pay if he receives from his employer his monthly wages without abatement in respect of the days on.

Construction industry players need to adhere to the health and safety provisions under the Occupational Safety and Health Act 1994 and the Factories and Machinery Act 1967. 37 Ordinary rate of pay means the staff members hourly daily or other rate of pay excluding Teaching Associate rates calculated on the base annual salary payable in accordance with the relevant classification as set out in Schedule 1 except where elsewhere provided in this Agreement. For example an employee who works 8 hours a day for a monthly salary of RM260000.

However after the 84-month period the employees income is taxed at ordinary rates. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax. 60F of Malaysia Employment Act 1955.

The facts are the same as in Example 1 except that the exchange rate on 1562019 was RM440 USD1 and the RM equivalent for USD10000 was RM44000. 38 Parties shall mean the University and the NTEU and any other union where. Not exceeding half his normal hours of work- 05 x ordinary rate of pay half-days pay ii.

This link brings you to a 3rd Party Website over which Standard Chartered Bank Malaysia Berhad has no control 3rd Party Website. It is applicable to Saturday Sunday as off-day. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24.

In Malaysia there are two types of public holidays. Chief petty officer qualified for lower rate of pay. To find out your investments true rate of return you need to take note of the interest rate and your placement period.

If you want to find out more about the different types of leave entitlements in Malaysia click here or you can find out about overtime pay rates hereAnd of course for all things HR head over to the altHR resources page.

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

0 Response to "Ordinary Rate of Pay Malaysia"

Post a Comment